Featured

Table of Contents

Nevertheless, keeping all of these acronyms and insurance policy kinds directly can be a frustration - best mortgage protection insurance. The adhering to table puts them side-by-side so you can swiftly set apart among them if you obtain confused. One more insurance policy coverage type that can pay off your home loan if you die is a typical life insurance coverage policy

A is in place for an established number of years, such as 10, 20 or 30 years, and pays your beneficiaries if you were to pass away throughout that term. A gives protection for your entire life span and pays out when you pass away.

One common general rule is to intend for a life insurance coverage policy that will pay up to ten times the insurance holder's income quantity. Alternatively, you may choose to use something like the dollar method, which includes a family's financial obligation, income, home mortgage and education and learning expenditures to calculate exactly how much life insurance policy is needed (insured mortgages).

There's a factor brand-new property owners' mail boxes are commonly pounded with "Last Possibility!" and "Urgent! Activity Needed!" letters from mortgage defense insurance providers: Several only permit you to purchase MPI within 24 months of shutting on your home mortgage. It's likewise worth keeping in mind that there are age-related restrictions and limits enforced by almost all insurance providers, that commonly won't give older purchasers as lots of options, will certainly charge them extra or might refute them outright.

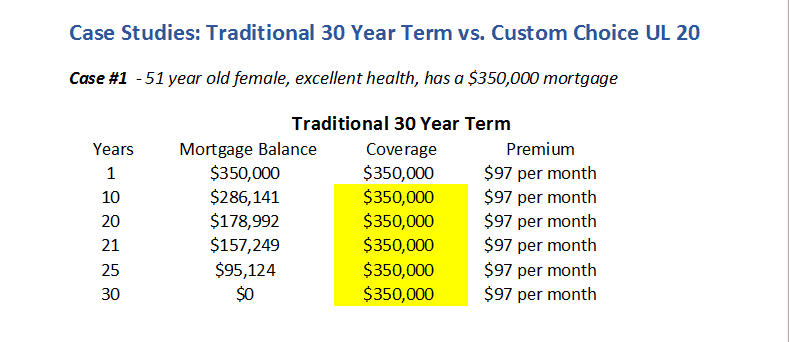

Right here's just how home mortgage protection insurance policy measures up against typical life insurance. If you're able to certify for term life insurance policy, you should avoid home mortgage protection insurance (MPI).

In those circumstances, MPI can give terrific comfort. Just make certain to comparison-shop and check out every one of the great print before registering for any kind of plan. Every home loan defense alternative will have countless guidelines, laws, advantage choices and downsides that need to be considered very carefully against your specific scenario (mortgage protection life insurance rates).

Mutual Of Omaha Mortgage Protection

A life insurance policy plan can help repay your home's home mortgage if you were to pass away. It is among several means that life insurance policy may assist shield your loved ones and their monetary future. Among the very best means to factor your home mortgage right into your life insurance policy need is to chat with your insurance policy agent.

As opposed to a one-size-fits-all life insurance coverage plan, American Household Life Insurance coverage Company uses policies that can be designed particularly to fulfill your family members's demands. Below are some of your choices: A term life insurance policy policy. life and mortgage protection is energetic for a particular amount of time and typically supplies a bigger quantity of coverage at a reduced cost than a long-term plan

A entire life insurance coverage plan is simply what it seems like. Instead than just covering an established variety of years, it can cover you for your entire life. It additionally has living benefits, such as money value buildup. * American Household Life Insurer uses different life insurance policy policies. Speak with your representative concerning personalizing a policy or a combination of policies today and obtaining the peace of mind you should have.

Your representative is a great resource to answer your inquiries. They might likewise be able to help you locate voids in your life insurance policy coverage or new ways to save on your various other insurance plan. ***Yes. A life insurance policy recipient can select to utilize the fatality benefit for anything - home protection insurance scheme. It's an excellent method to help safeguard the monetary future of your family if you were to die.

Life insurance coverage is one way of aiding your family members in paying off a mortgage if you were to pass away prior to the mortgage is completely settled. Life insurance coverage earnings might be made use of to assist pay off a home mortgage, however it is not the exact same as mortgage insurance policy that you may be required to have as a problem of a car loan.

Life Cover For Mortgage Protection

Life insurance may help guarantee your home remains in your household by offering a fatality benefit that might help pay down a home mortgage or make vital acquisitions if you were to pass away. This is a short summary of insurance coverage and is subject to policy and/or biker terms and conditions, which might vary by state.

Words life time, long-lasting and irreversible undergo policy terms and conditions. * Any type of lendings extracted from your life insurance policy plan will certainly build up passion. homeowners insurance vs mortgage insurance. Any type of impressive loan balance (lending plus passion) will certainly be deducted from the survivor benefit at the time of claim or from the cash money worth at the time of surrender

Discount rates do not use to the life policy. Plan Types: ICC18-33 (10 ), ICC18-33 (15 ), ICC18-34 (20 ), ICC18-35 (30 ), L-33 (10 )(ND), L-33 (15 )(ND), L-34 (20 )(ND), L-35 (30 )(ND), L-33 (10 )(SD), L-33 (15 )(SD), L-34 (20 )(SD), L-35 (30 )(SD), ICC18-36 (10 ), ICC18-36 (15 ), ICC18-36 (20 ), ICC18-36 (30 ), L-36 (10 )(ND), L-36 (15 )(ND), L-36 (20 )(ND), L-36 (30 )(ND), L-36 (10 )(SD), L-36 (15 )(SD), L-36 (20 )(SD), L-36 (30 )(SD), ICC17-225 WL, L-225 (ND) WL, L-225 WL, ICC17-227 WL, L-227 (ND) WL, L-227 WL, ICC17-223 WL, L-223 (ND) WL, L-223 WL, ICC17-224 WL, L-224 (ND) WL, L-224 WL, ICC17-228 WL, L-228 (ND) WL, L-228 WL, ICC21, L141, MS 01 22, L141, ND 02 22, L141, SD 02 22.

Home mortgage protection insurance (MPI) is a different kind of safeguard that can be practical if you're not able to repay your home loan. Mortgage protection insurance is an insurance coverage policy that pays off the remainder of your home mortgage if you pass away or if you become impaired and can't function.

Like PMI, MIP secures the lending institution, not you. Unlike PMI, you'll pay MIP for the period of the car loan term. Both PMI and MIP are called for insurance policy coverages. An MPI plan is completely optional. The amount you'll pay for mortgage protection insurance policy relies on a range of variables, consisting of the insurer and the present balance of your home mortgage.

Still, there are pros and cons: Most MPI plans are issued on a "assured approval" basis. That can be helpful if you have a wellness problem and pay high rates forever insurance or struggle to get protection. death benefit mortgage insurance. An MPI plan can supply you and your family members with a complacency

Mortgage Cover For Death

It can likewise be practical for people that do not get or can't pay for a typical life insurance policy plan. You can choose whether you require home mortgage protection insurance policy and for how lengthy you need it. The terms generally range from 10 to thirty years. You may desire your home loan defense insurance term to be close in length to for how long you have delegated repay your mortgage You can cancel a mortgage protection insurance coverage.

Latest Posts

Final Expense Insurance For Cremation

Instant Quote Term Life Insurance

Buy Burial Insurance