Featured

Table of Contents

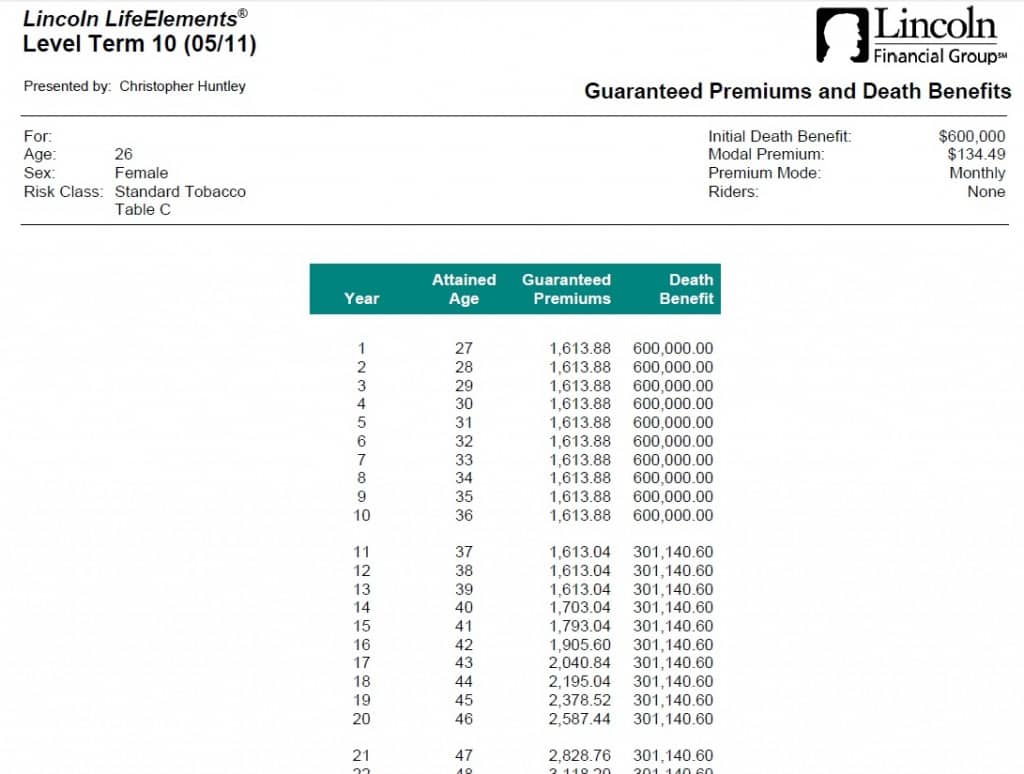

A level term life insurance policy policy can provide you tranquility of mind that the individuals that rely on you will certainly have a survivor benefit throughout the years that you are preparing to support them. It's a means to aid care for them in the future, today. A degree term life insurance policy (in some cases called level costs term life insurance policy) plan provides protection for a set number of years (e.g., 10 or 20 years) while keeping the costs settlements the same for the duration of the policy.

With degree term insurance coverage, the price of the insurance coverage will certainly stay the exact same (or possibly lower if returns are paid) over the regard to your policy, usually 10 or twenty years. Unlike long-term life insurance policy, which never ends as long as you pay premiums, a level term life insurance coverage plan will end at some time in the future, normally at the end of the period of your degree term.

What is a Level Term Life Insurance Policy Policy?

As a result of this, lots of people use long-term insurance as a secure financial planning device that can serve many needs. You may be able to convert some, or all, of your term insurance throughout a collection duration, usually the initial one decade of your plan, without requiring to re-qualify for insurance coverage also if your health has actually changed.

As it does, you might want to add to your insurance policy coverage in the future - Level term life insurance policy. As this occurs, you may desire to ultimately decrease your fatality advantage or take into consideration converting your term insurance to an irreversible plan.

Long as you pay your premiums, you can relax easy recognizing that your loved ones will certainly obtain a fatality advantage if you die throughout the term. Many term policies allow you the capability to convert to long-term insurance without needing to take another health exam. This can permit you to make use of the added advantages of a long-term policy.

Level term life insurance policy is one of the easiest paths right into life insurance policy, we'll go over the benefits and disadvantages so that you can select a plan to fit your requirements. Degree term life insurance coverage is the most common and basic form of term life. When you're seeking momentary life insurance plans, degree term life insurance policy is one course that you can go.

The application process for level term life insurance policy is typically very straightforward. You'll submit an application that contains general personal information such as your name, age, and so on along with a much more in-depth survey regarding your case history. Depending on the plan you want, you may need to get involved in a medical checkup procedure.

The brief response is no., for instance, allow you have the convenience of death advantages and can accrue cash worth over time, implying you'll have much more control over your advantages while you're active.

What is Term Life Insurance With Accidental Death Benefit? Find Out Here

Motorcyclists are optional provisions included to your plan that can offer you extra benefits and securities. Anything can take place over the training course of your life insurance term, and you desire to be ready for anything.

There are circumstances where these benefits are developed right into your policy, however they can likewise be offered as a different addition that requires added repayment.

Latest Posts

Final Expense Insurance For Cremation

Instant Quote Term Life Insurance

Buy Burial Insurance