Featured

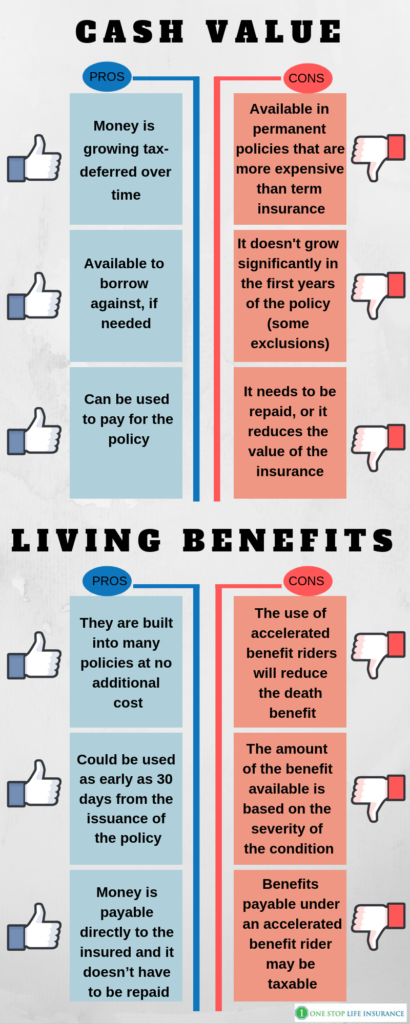

Cash money worth is a living advantage that remains with the insurance provider when the insured passes away. Any type of exceptional finances versus the cash money worth will certainly reduce the policy's survivor benefit. Protection plans. The plan owner and the guaranteed are normally the same person, yet often they might be different. As an example, a business could get essential individual insurance coverage on an important employee such as a CHIEF EXECUTIVE OFFICER, or an insured might market their very own policy to a 3rd party for money in a life negotiation.

Latest Posts

What is What Is Level Term Life Insurance Coverage Like?

The Benefits of Choosing Term Life Insurance For Spouse

What types of Wealth Transfer Plans are available?